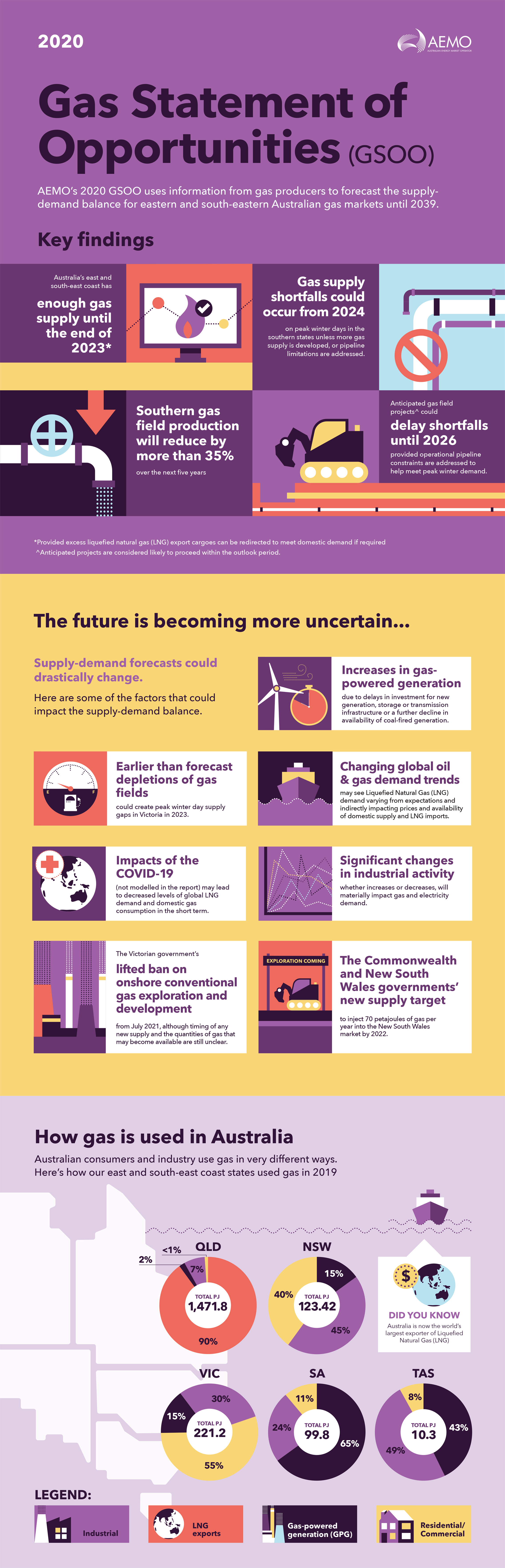

The Australian Energy Market Operator’s (AEMO) latest analysis finds that supply from existing and committed gas developments on Australia’s east and south-east coast will meet gas demand until the end of 2023, provided excess liquefied natural gas (LNG) can be redirected to meet domestic demand, if required.

Consistent with the findings released in 2019, AEMO’s 2020 Gas Statement of Opportunities (GSOO) and 2020 Victorian Gas Planning Report Update (VGPR Update) have identified a projected shortfall of gas supply on peak winter days in the southern states from 2024, unless more southern supply sources are developed, or pipeline capacity limitations are addressed.

“Supply from existing and committed southern gas developments is expected to reduce by more than 35% over the next five years, despite the increase in newly committed gas projects over the last 12 months,” said AEMO’s Managing Director and CEO, Audrey Zibelman.

The decline in supply is due to updated forecasts from gas producers that show several existing gas fields could end production between mid-2023 to mid-2024. If production from these fields ends earlier, southern states could experience peak winter day supply gaps as early as 2023.

The report’s forecast also shows that anticipated gas field projects, which are likely to proceed over the next few years, could improve supply until 2026; however, pipeline limitations will still need to be addressed to help meet gas demand during peak winter days.

“The risk of peak day shortfalls could be resolved by a wide range of different options, some of which are already being explored by industry and governments,” said Ms Zibelman.

“This could include the development of new LNG import terminals, pipeline expansions, or new supply that could result from the Victorian Government’s decision to lift the ban on onshore gas exploration from July 2021. The Commonwealth and New South Wales’ government have also proposed a target to inject 70 petajoules of gas into our energy markets by 2022,” said Ms Zibelman.

The reports also flag the increasing amount of forecast uncertainties, particularly in 2022-2024, when decline in southern production coincides with the staged closure of Liddell Power Station.

“As the energy industry transforms, the growing linkages between Australia’s gas and electricity sectors mean that events occurring in one sector, could have strong impacts on the other,” said Ms Zibelman.

Any delays to the projects identified in AEMO’s Integrated System Plan, a further reduction in availability of Australia’s coal-fired generation fleet, earlier than forecast depletions of gas fields, long-term changes in industrial activity, changes to the global LNG markets, or the ongoing effects of COVID-19 could all heavily impact current forecasts.

“Close collaboration between AEMO, market bodies, industry and state and federal governments will be a critical component to the success of our energy transformation. AEMO will continue to work closely with all parties in the best interest of consumers, and to shape a better energy future for all Australians,” said Ms Zibelman.

For an in depth discussion on AEMO’s 2020 GSOO and VGPR Update check out our latest Energy Live podcast with Alex Wonhas, AEMO’s Chief System Design & Engineering Officer, and Rachel Saw, AEMO’s Stream Lead - Market Operability, below:

AEMO's 2020 GSOO & VGPR Update

For all the latest news, insights and analysis from

the Australian energy industry subscribe to our fortnightly

newsletter and download the Energy Live app on Apple or Android.